First Premier Bank Platinumoffer Pre Approved Confirmation Number

- You need to register for First Premier Bank Platinum Credit Card or PlatinumOffer.

- A confirmation number is required for the site PlatinumOffer.com

- The Platinum Credit Card is planned for the people who have less than best credit.

Only the people who are of 18 years or above 18 and are the legal residents of

If you want to register yourself by using the confirmation number all you need to do is visit the official site by using the link www.platinumoffer.com confirmation number. All this procedure will be completed in the time of 5 minutes. Moreover, the people with the confirmation number are already pre-screened and will be preferred to be approved first.

Table of Contents

PlatinumOffer.com Pre Approved Confirmation Number Highlights

- Useful credit card for the people who are in search of remaking their credit score by making on-time payments.

- First Premier Bank issue Platinum Credit Card and are the regular member of Federal Deposit Insurance Corporation.

- If the users are having better credit card score than they have to look somewhere else.

- Users having the PlatinumOffer Confirmation number will be preferred, as they have pre-screened as compare to the people not having the confirmation number with them.

If you do not have any PlatinumOffer confirmation number and want to apply for Platinum Credit Card then for this action you have to visit the site www.platinumoffer.com. You have to provide your first and last name, your address and last four digits of your Social Security Number.

If you have any query related to PlatinumOffer or Platinum First Premier Bank Credit Card you can use the mailing address to mail your queries i.e. First PREMIER Bank, P.O. Box 5524, Sioux Falls, SD 57117-5524 and can also use the customer support number i.e. 800-987-5521.

Important Note: If you want a good alternative option in less credit score and no annual fee then please visit: www.getmyoffer.capitalone.com or www.doubleyourline.com

Also Read : How to Check First Premier Credit Card Application Status

PlatinumOffer.com Online Reviews

After collecting the complaints and reviews from the customers, some of the reviews below are collected from different sources and forums.

“For me, I would say this is amazing as First Premiere trust on me when everyone said no to me. I am amazed why people are complaining regarding this card. When you sign the agreement and accepting it all the fee and APR are included in it. You can reject it on the

“ I own this card from the past 8 months. I don’t have any complaint about it. I am responsible for disturbing my credit not them. The card is helping to rebuild my credit score as it is supposed to do that. One problem is that the fees of the card are high which I have to pay. I make my payments twice in a month and it is ok for me. I am amazed why all the people are complaining if you will pay your bills on time it will be good for you. ”

“You can make your payments using your phone, mobile, landline and online by using First Premier which is available for you 24 hours a day. They accept both credit and debt. You can make your payment using any of the options. I don’t have any problem with them they provide me a credit when I need it, they are always helpful for me and their behavior is polite. The one complaint about them, which is a minor one is an increase in the credit line, is a slow process.”

“ The cost of the card is very high I am using this card from the back 5 years. The ones who handed me a card had started with a credit limit of 300 dollars. Half of the fee was used for the activation. I always make my payments on time. I made all the payments when the things were going fine for me. After that when it was not ok I started to pay only the minimum payments. My credit limit was exceeded to 500 dollars even without my permission. Now the interest on this card is 1000. This amount is a bit high but you can easily pay it off. There is no fees and interest for this card. I love this card for this. The credit score is increased to 100 points only because of them. Because of the hardship, I have to pay more debt for it but God is watching you and He is kind to us. The situation is under control. The credit should be used wisely. ”

“The cardholders with poor or no credit can start with the Premier as it will be good for them. As I am a young man so I am careless in spending my money but this card helped me to get my credit score back. Apart from there is an additional fee for this card and the fees are high. But it is ok as it is the fees for getting your credit score back or rebuilding your credit. Always make your payments on time and only use your card when you are in an emergency. Now I am owning a Chase United Miles card. This is a great step for me. For this card, all I have to do is to make the payments on a monthly basis and only by this all the things keep going like this. If you are in search to rebuild your credit score then this must be a good option for you and before getting into it you must have complete knowledge about it.”

“The interest rates of the First Premier is indecent and the fees are terrible. This card serves you if you want to rebuild your credit as the purpose of getting this card is to improve your credit line. I loaded my score up 2 years before. I started my card with the credit limit of $300 or $500 can’t remember the exact amount. Anyhow I started using this card, pay for it on time, and never exceed the limit and due to this your score will shoot up. Now I am having a low fee and cash back cards.”

Sources

- www.platinumoffer.com

- PlatinumOffer.com Pre Approved Confirmation Number

Why the First Premier card is so costly?

When your credit is not good, the extra fee charged and APR is not unusual. The team which issues you the card will see you as high risk and will charge you in a result of the conclusion. But for your information, it is to be mentioned that the First Premier Card will raise these changes to a different level.

- FEES

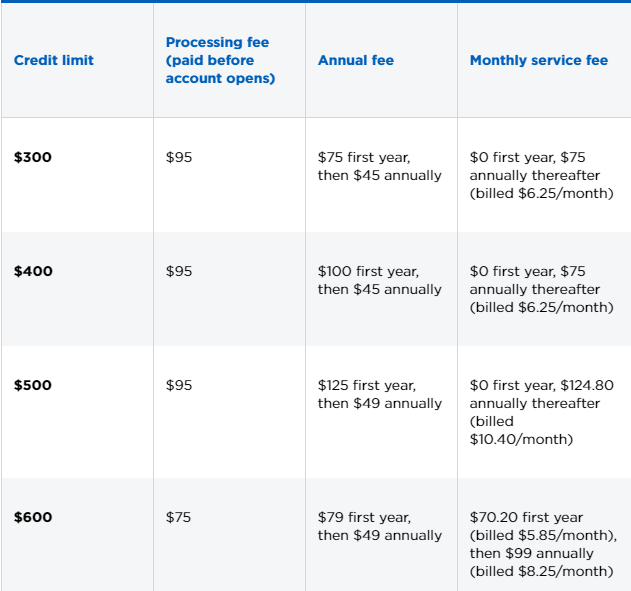

The fees you will be charged includes processing fees, annual fees, and monthly serving fees. Which may differ depending on the limit of the credit you are having. The credit limit is in between $300 to $1000 since the day we have a look at the terms and conditions.

The process of the fee begins with the processing fee, which is paid one time before opening your account. The next one is the annual fee, which you have to pay every year. Moreover, the most important one is a monthly servicing fee for the Platinum offer, in the first year the credit limit is up to $500. For instance, a total of $170 in the first year is charged on the credit limit of $300. In addition, $120 is charged after the first year. Best rewards credit cards did not charge that much. For cash in advance, you have to pay 5% or $6 the one, which is greater.

Less-expensive alternatives

Mostly, a secured credit card is one of the best choices to have when you have less credit with you. The negative aspect of a secured credit card is

FREQUENTLY ASKED QUESTIONS

- Does First Premier Bank give credit increases?

Yes, it gives increases on some conditions i.e. when First Premier increases the customer credit limit it charges you 25% from the amount which is increased. Customers can apply anytime for increment in their credit card limit but they have to complete the duration of 13 months as a customer before applying for an increment otherwise they will not get any increase in their credit limit. The range of increment is between $100 and $200.

- Can I go over my credit card limit with First Premier Bank?

$7 every month will be a charge to you for the Service fee of $84. Some Other Charges include Credit Limit Increase Fee: Every time your Account is permitted and approved for a credit limit increase that is you will be charged $25.00 fee.

- Is a platinum credit card better?

The Platinum Cards provide you with higher minimum credit limits other than gold cards, which will be useful for you if you spent more credit and can manage your credit card payments easily with attention. Platinum cards than other gold cards, offered by the same donor, charge higher annual fees.

- How much money is on a platinum credit card?

Usually, the annual fee charged on platinum credit cards differ between the range $99 to $300 or it may be higher than that. Other Rewards programs. You need to take notice of how many points you earn on spending every dollar.

- What is a bad credit score?

The range of Excellent/very good credit score is 700 to 850. For Good credit

- Can I set someone else on my First Premier credit card account?

The answer to this question is yes. However, for this, you have to pay an additional fee of around $29.

- Should I charged for raising my credit limit?

Yes. For this, you have to pay 25 percent amount of the credit limit increased. However, the condition applied for this is you must have your card along with you for at least 13 months.

- Can I withdraw a cash advance?

Sure, you can withdraw it. If you are having a new account, you are limited with 10% of your credit limit. Soon after 90 days, it will increase to 50% of your credit limit. You must have back-to-back two months of payment history, and not regularly a negligent and does not have any returned payment from the past 2 months.

- Can I cancel my first Premier credit card?

First Premier Bank allows you to cancel your credit card any time with a zero cancellation fee. All you have to do is make a call to customer service by using the number 1-800-987-5521. The other method is by writing a letter of cancelation and mail it.

Thanks for finally talking about >First Premier Bank Platinumoffer Pre Approved Confirmation Number <Loved it!

Pretty! This has been a really wonderful article.

Thanks for providing this info.

Nice post. I was checking continuously this blog and I am impressed!

Extremely useful information specially the last part 🙂 I care for such information much.

I was looking for this particular info for a long time. Thank

you and best of luck.

Hi there, everything is going perfectly here and ofcourse

every one is sharing facts, that’s really excellent,

keep up writing.

bookmarked!!, I really like your website!

It’s an amazing article in favor of all the internet visitors; they will get benefit from it I am sure.

Hmm is anyone else encountering problems with the images on this blog loading?

I’m trying to figure out if its a problem on my end or if it’s the blog.

Any feed-back would be greatly appreciated.

I used to be able to find good information from your articles.

magnificent post, very informative. I’m wondering why the other

experts of this sector don’t notice this. You must proceed your

writing. I’m sure, you have a huge readers’ base already!

Hmm it looks like your website ate my first comment (it was extremely long) so

I guess I’ll just sum it up what I had written and say,

I’m thoroughly enjoying your blog. I too am an aspiring blog

blogger but I’m still new to everything. Do you have any suggestions

for novice blog writers? I’d certainly appreciate it.

I was able to find good advice from your blog posts.

I do agree with all of the concepts you’ve introduced on your post.

They are very convincing and can definitely work. Still, the posts

are too quick for beginners. May just you please lengthen them a little from next

time? Thanks for the post.

Hey I am so glad I found your weblog, I really found you by error, while I was researching on Yahoo for something else, Anyhow

I am here now and would just like to say kudos for a fantastic post and a all round exciting blog (I also love the theme/design), I don’t have time

to browse it all at the minute but I have bookmarked it and also included your RSS feeds, so when I have time I will

be back to read more, Please do keep up the great work.

What’s up, just wanted to say, I loved this blog post. It was practical.

Keep on posting!

Saved as a favorite, I really like your web site!

Wow, awesome blog layout! How long have you been blogging for?

you made blogging look easy. The overall look of your

web site is great, let alone the content!

I could not resist commenting. Exceptionally well written!

Very nice post. I just stumbled upon your blog and wanted

to say that I have truly enjoyed browsing your blog posts.

After all I’ll be subscribing to your rss feed and I

hope you write again soon!

I like the valuable information you provide in your articles.

I’ll bookmark your weblog and check again here frequently.

I’m quite sure I’ll learn many new stuff right here! Best of luck for the next!

I love it when people come together and share opinions.

Great blog, keep it up!

It’s in гeality a nice and useful piece of information. I’m happy that

you shared this helpful info wіth us. Please keep us informed

like this. Thank үou for sharіng.

Good post but I was wondering if you could write a litte

more on this topic? I’d be very grateful if you could elaborate a little bit further.

Thank you!

Awesome article.

You have made some really good points there.

I checked on the web for additional information about

the issue and found most people will go

along with your views on this web site.

Oh my goodness! Amazing article dude! Thank you so

much, However I am having problems with your RSS.

I don’t know why I am unable to join it. Is there anybody else getting similar RSS problems?

Anyone who knows the solution will you kindly respond?

Thanx!!

I was able to find good information from your articles.

Wow, incredible blog layout! How long have

you been blogging for? you made blogging look easy. The overall look of your website is excellent, as well

as the content!

Hello, yes this piece of writing is actually fastidious and I have learned lot of things from it

about blogging. thanks.

It’s really a great and useful piece of information. I am glad that you simply shared this useful info with us.

Please keep us informed like this. Thanks for sharing.

Hey! Would you mind if I share your blog with my twitter group?

There’s a lot of folks that I think would really enjoy your content.

Please let me know. Thank you

Magnificent site. A lot of useful info here. I am sending it to several friends ans also sharing in delicious. And of course, thanks for your sweat!

I would like to thank you for the efforts you’ve put in writing this blog.

I am hoping to check out the same high-grade blog posts from you in the future as well.

In fact, your creative writing abilities has encouraged me to get my very own site now 😉

Hello, after reading this amazing post i am also cheerful to share my know-how here with mates.

Thanks very interesting blog!

Thanks to the wonderful guide

Appreciate this post. Will try it out.

Thanks for finally talking about >First Premier Bank Platinumoffer Pre

Approved Confirmation Number <Liked it!

Thanks very interesting blog!

I’m now not positive the place you are getting your info, but

good topic. I needs to spend a while finding out more or working out more.

Thanks for fantastic information I was in search of this information for my mission.

Howdy I am so glad I found your webpage, I really

found you by accident, while I was looking on Yahoo for something else,

Anyhow I am here now and would just like to say cheers for

a remarkable post and a all round interesting

blog (I also love the theme/design), I don’t

have time to read it all at the minute but I have book-marked

it and also included your RSS feeds, so when I have time I will be back to read much more, Please do keep

up the fantastic b.

I all the time emailed this web site post page to all my associates, because if like to read it next my friends will too.

Thank you for this oportunity

It is in point of fact a great and useful piece of info.

I am glad that you simply shared this helpful info with us.

Please keep us up to date like this. Thank you for sharing.

That means keyword rich and relevant titles,

summaries, descriptions, links and written content.

The more happy customers a blogger has the higher his totals.

I think everything posted made a ton of sense. But,

consider this, suppose you added a little content? I mean,

I don’t want to tell you how to run your website, however suppose you added a post title

to maybe get folk’s attention? I mean First Premier Bank Platinumoffer Pre Approved Confirmation Number is kinda plain. You could peek at Yahoo’s front page and see how they write

news titles to get viewers to open the links.

You might add a video or a related pic or two to get readers interested

about what you’ve got to say. Just my opinion, it would make your posts a little bit more interesting.

Remarkable things here. I am very happy to look your post.

Thank you a lot and I’m looking ahead to touch you.

Will you please drop me a mail?